What is the Value of High Interest Savings Accounts for your municipality?

During the pandemic many municipalities found themselves doing something that they had not often done in years prior, that is buying GICs as part of their municipal investment strategy. Since their introduction post financial crisis High Interest Savings Accounts (HISAs) had, for the most part, replaced GICs as the preferred place for municipalities to invest surplus balances. It’s why the ONE Investment Pooled HISA program was established.

The HISA came to dominate the deposit market during this period given their ease of use, ease of making deposits and withdrawals, full liquidity, no term commitments, opportunity to use more than one bank for diversification, and that they were often paying rates equal to or better than many GIC terms.

In 2022, the Bank of Canada began hiking its overnight rate in response to a rising inflation rate in Canada, the yield curve steepened as term rates built in expectations for future rate hikes, which coincided with increases in bank credit spreads (see note 1) in the bond market, and GIC rates began to rise. These higher GIC rates provided depositors a reasonable choice for the first time in over 10 years between their HISA and Term GICs. Many with term surplus funds choose the GICs.

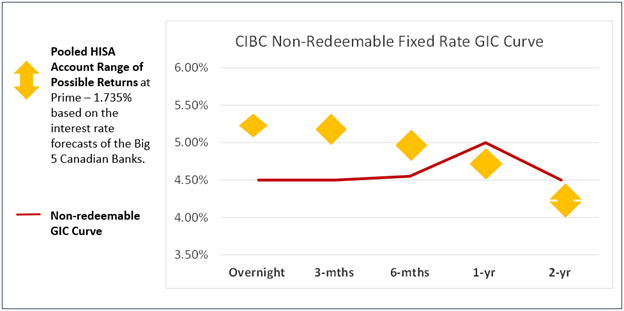

With the now flatter/inverted yield curve (see note 2), and lower bank credit spreads the rate advantage that GICs had offered in 2022 and 2023 has been reduced/eliminated. The chart below looks at the potential return of funds invested in ONE’s existing Pooled HISA offering vs some sample term GIC rates as of the same date, and based on the current rate forecasts of the big 5 banks.

As outlined in the example above the potential returns on the Pooled HISA program would outperform the sub-1-year GICs based on all the rate forecasts of the big 5 Banks. At the 1-yr term the HISA may provide a similar return as the GIC if one of the big bank rate forecasts is correct. If the other four forecasts are correct the HISA would return potentially lower returns.

Of course, forecasting interest rates can be a guessing game so all forecasts should be taken with a grain of salt. Economic forecasts globally have progressed from the question being about “hard or soft landings”, to a new revision to incorporate a new “higher for longer” stance on both the economy and interest rates in the past year. Given this we are seeing more rate cuts being revised out of forecasts recently, making it even harder to choose when to lock in fixed rates, especially when those rates are lower than what you could earn today in your HISA.

The decision on which deposit solution a municipality may choose is dependent on how long until the funds will be needed and your confidence in these expected timelines. We often see municipalities trade off yield vs liquidity given these factors, the spread between the possible returns, and simply the roll the municipal funds in question have within the organization’s overall deposit & investment portfolio.

As they say, it's nice to have a choice so be sure to consider all your options.

Notes:

- Bank Credit Spreads – measures the difference in yields between a Bank bond and another bond, usually a government bond considered to be “risk free”. The credit spread is a measure of the perceived risk difference between the two bonds as valued by the bond market.

- Inverted Yield curve – where longer term rates are lower than short term rates.